Published at: https://libranews.com/2021/06/18/using-the-fear-greed-metric-to-boost-your-crypto-portfolio/

The fear & greed index is a metric that combines data from various sources to show how fearful or greedy the market is on a particular day.

It is a measure of the market sentiment, on a scale of 0 to 100. Zero means “extreme fear” while 100 means “extreme greed.”

Warren Buffett, one of the greatest investors of all time, said “be fearful when others are greedy, and be greedy when others are fearful.”

So, when the fear & greed index shows that the market is extremely fearful, that could be a buying opportunity. When the meter shows extreme greed, that means the market is due for a correction.

Jason Pizzino, a stock and crypto trader, shared his strategy for investing in the digital asset.

The strategy is to buy when the fear & greed index is 15 or below, because that is when the market is fearful and we should be “greedy”.

He keeps a progress tracker on an Excel sheet. If you were to follow this simple strategy, even if you started well into the bull market in May this year, you would have been up by at least 10% today.

He says this strategy works because there is very little stress involved.

You do not need to be worried about being too late to the market – aka FOMO – which may cause you to invest when the market is too hot.

You also do not need to worry about how much to invest, as you are contributing a fixed amount every time the fear & greed index is 15 or below.

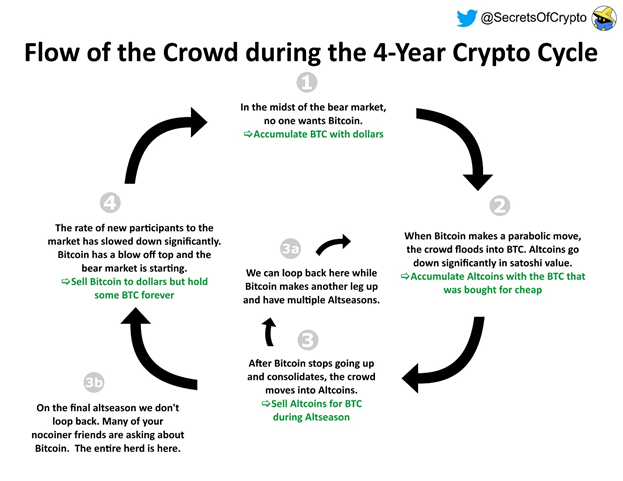

This strategy is part of a bigger one, where you begin with buying bitcoin during the early stages of a bull market.

As the bull market progresses, bitcoin’s price will go up, until it eventually plateaus and investors begin to seek other opportunities, namely altcoins.

This is when altcoins start to pump – also known as altseason – until the prices increase at an unsustainable rate, and the everything comes crashing down.

Anticipating this cycle, the strategy is to start by focusing on bitcoin.

At the moment, we may be sitting in an accumulation phase, where the price is trading sideways within the $32,000 – $42,000 range, and institutional investors with large capital are buying at a relatively cheap price at a slow pace.

Once the accumulation phase is over, we should enter a distribution phase, where this time, large institutional investors will buy aggressively within a short time frame to squeeze the supply and drive the prices up.

These accumulation and distribution cycles are part of Wyckoff’s method, which happens in any market.

By accumulating bitcoin and staying away from altcoins first, you are positioning yourself to get ahead of the curve, as historically, bitcoin will be the first to pump.

As bitcoin’s prices start to rally, greedy investors will begin to sell off their altcoins to buy bitcoin, and this will cause altcoins to bleed.

This is where, you, as a forward-thinking investor, should start to buy those cheap altcoins using the gains you got from the bitcoin rally.

After bitcoin price plateaus and investors greedily look for greener pastures in the form of altcoins again, this is when you sit tight and wait for your altcoins to pump, and sell off once you see indications that the market is too hot.

One of these indicators is the fear & greed index. When the market is too greedy, that is when you sell.

It is important to stick to this simple plan, and not fall for short term altcoin rallies that may happen during the bitcoin accumulation phase.

Some altcoins will even have 10-20% rallies in a day, which may tempt many to swarm to those altcoins, only to see them bleed again as bitcoin prices go up.

Unexperienced retail investors may think that they will be able to buy low and sell high just by looking at the charts, but from my personal experience, this is not an easy thing to do.

I have tried buying an altcoin when its price fell close to a major support level.

I thought it was a great buying opportunity. However, in those few minutes, I was afraid that the price would drop even further beyond the support level, so I held off on buying.

I started to scramble for information on the internet as to why the prices were falling, just in case there was some fundamental change to the altcoin that would drop its price even lower.

However, by the time I was convinced that there was nothing to worry about, the price had already bounced back, causing me to lose my window of opportunity.

But the story doesn’t end there. Initially, I thought the price would go up by 10-20% in a matter of days. That would be a solid return for just clicking a few buttons.

So, when the price did go up by that much and by that fast, I was frustrated thinking about what could have been, had I acted confidently when I had my chance.

However, in next few days, the price went up by another 32%, as it rode on the bullish news that Tesla would adopt bitcoin again once half of its mining activities came from renewable energy.

So, even if I did act swiftly and bought the so-called “dip”, I would still be disappointed because I would have sold it when it reached a 10-20% gain, when the price actually soared by 42%.

On a short timescale, nobody can tell where the market is heading. Being a new investor, trying to play the day trading game is like playing with fire. You might just get burned.

If not by losing money, then by the stress it causes.

This is why I like Jason Pizzino’s low stress investment strategy.

It takes the emotions out of the equation, and allows you to be “fearful when others are greedy, and be greedy when others are fearful.”

In a market where there are now institutional investors who have enough capital to manipulate the market, this is more important than ever.

Good luck and happy investing.