Published at: https://bangiboy181.medium.com/how-to-get-paid-to-learn-blockchain-development-d517684fd5e7

Does this sound familiar to you?

You are interested in learning something, hoping that one day, you can make money out of it.

You spend days, weeks, or even months learning it, telling yourself “It will all be worth it” when you build that next killer product.

You sacrifice valuable time away from the people who love you, when suddenly, you realize that you have only scratched the surface, and that you are still miles away from being an expert.

Your skills are still mediocre, and you need to spend a lot more time learning before you would be able to make a single cent.

You feel lost. “All that time spent for nothing.”

And eventually, you give up.

Don’t worry, because you are not alone. This happens to more people than you think.

I recently stumbled upon a video called “How to Get PAID to Learn Blockchain Development”.

It piqued my interest because, usually you would need to “pay” in order to learn, not “get paid”.

But in this video, I learned that you can actually get paid to learn blockchain development. Here is how.

Getting paid to learn

You can get paid to learn blockchain development by starting to work.

But “How?” you may ask.

Contrary to popular belief, you don’t need to be an expert to get hired.

Most beginners doubt themselves and delay applying for a job, with an excuse that they are not good enough.

However, there are opportunities to learn while you are working.

Yes, you may not be the one who leads the project, but you can bring value by mastering just one specific niche, and start to expand from there.

You may be wondering; how do you sharpen your skills if you are just starting out?

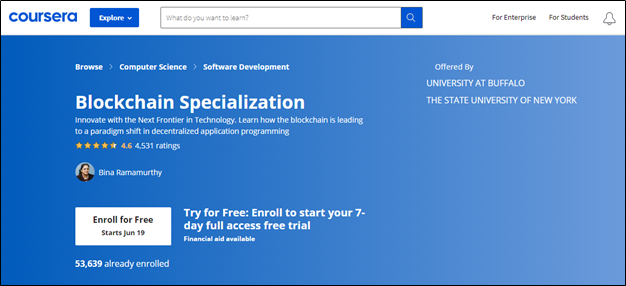

There is a free program on Coursera that teaches you how to specialize in Blockchain.

The “Blockchain Specialization” program consists of 4 courses:

- Blockchain Basics

- Smart Contracts

- Decentralized Applications (Dapps)

- Blockchain Platforms

Let’s look into these courses one by one, starting with Blockchain Basics.

The Blockchain Basics course “provides a broad overview of the essential concepts of blockchain technology – by initially exploring the Bitcoin protocol followed by the Ethereum protocol – to lay the foundation necessary for developing applications and programming.”

Once you have the foundation, you can move on to build smart contracts and Dapps, which is what the second and third courses allow you to do.

Finally, the fourth and final course, Blockchain Platforms, “provides learners with an understanding of the broader blockchain ecosystem”. It covers “other blockchain platforms, details of two decentralized application use cases, and challenges such as privacy and scalability.”

All of these courses have video explanations, reading materials, and practice exercises. There is also a project at the end of the first three courses for you to harness your power.

After you complete the program, you are one step closer to your blockchain development career.

The next thing you need to do is to start your own project using the concepts you learned.

Starting your own project

Your project can completely different than the examples shown in the program. It is completely up to you.

You are free to make it as simple or as ambitious as you like.

The goal here is to demonstrate that you have a working knowledge of how to build a blockchain application from scratch.

Sometimes, your application needs something that was not explicitly covered in the Coursera program. If you like, you can begin to explore the resources available online, such as YouTube tutorials, forums like Stack Overflow, or technical documentations.

Once you have a working application, you can use it to land your first job.

Here, you will be paid to learn about blockchain development in more detail.

This is a process used by many developers, because learning to be an expert is quite difficult without getting paid.

You may get demotivated learning by yourself for months or years without seeing a return on your effort.

Also, even if you did start with a formal learning path such as a computer science degree or a coding bootcamp, you will still need to learn on the job because the computer science industry is constantly evolving.

Conclusions

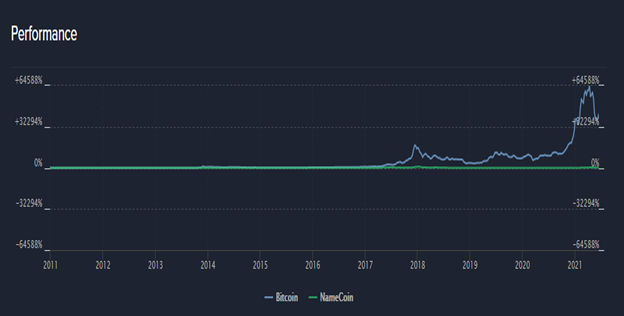

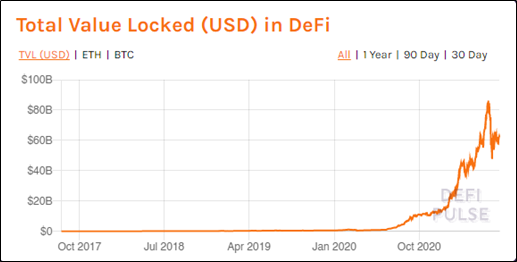

Blockchain technology is at the front of revolutionizing many industries, especially the financial sector.

This would bring many benefits, such as:

- giving financial access to underserved populations,

- reducing transaction costs in trade and economy, and

- creating higher quality services and products.

So, I believe that blockchain development is such an important job that it will be the bedrock of a better future.

If you are interested in learning blockchain development, I encourage you to give it a shot.

Good luck and happy learning!